Want an Edge? Start Here

I could churn out post after post on perfecting your trading psychology, mastering obscure candlestick patterns, or finding the perfect trading tool. But let’s be honest—none of that matters unless you have one thing:

A strategy with a real edge—and the discipline to execute it.

You can have monk-like discipline, read charts like scripture, and stack every high-end tool available… but if you don’t have an edge? It’s all noise.

And let’s be honest—that’s why you’re here. You want an edge.

No Secrets. No Shortcuts. Just Structure.

Now, this is where I part ways with most of the talking heads on X, Substack, in books, and YouTube courses. I’m not here to hand you some "secret can’t-lose" strategy in exchange for your dollars. That’s not how this works, and it’s not how real edge is built. My goal is to push you toward discovering that edge for yourself—and then building your strategy around it. That’s the correct approach. It doesn’t just give you a tactic—it trains your instincts, sharpens your strategy-building skills, and teaches you why the edge exists in the first place.

So let’s use this post to point you toward a sector—or better yet, a trading universe—that holds some of the most powerful edge available when paired with the right strategy.

That’s the real goal: find a market, product, or sector that’s structurally inefficient or inherently flawed, and then build a strategy to exploit it.

That’s where true edge lives—not in guessing market direction from a chart pattern, but in systematically taking advantage of the inefficiencies baked into the system.

The Best Trade?

Let’s start with the most common question I get:

“What’s the best trade right now?”

My answer hasn’t changed in years:

Short $UVXY.

And frankly, it’s probably the best advice I’ve ever given. Since 2011, $UVXY has gone from nearly $100 billion in value (split-adjusted) to just $27 in mid-2025. Yes, you read that right. From a hundred billion to twenty-seven dollars. And the odds are strong it’s even lower by the time you're reading this.

Unfortunately, it seems everyone has passed on this trade of a lifetime, and tragically, I have even ignored my own advice, employing less lucrative VIX trading strategies over the years.

It’s not just me screaming “Short this pile of crap!”, even $UVXY’s prospectus states the obvious:

“If you hold your $UVXY ETN as a long-term investment, it is likely you will lose all or a substantial portion of your investment.”

It seems regulators operate under the fantasy that traders and investors diligently comb through every page of a prospectus before placing a trade. Otherwise, it seems like they would do a better job of protecting the masses from buying such a piece of shit. But instead of venting at useless bureaucrats, let me explain more about the VIX and its “glitchy” trading instruments such as $UVXY, and how these regulators' negligence can provide the trading opportunities of a lifetime.

What is the VIX?

I won’t get overly technical here—we’ll keep things simple. But if you’re serious about understanding volatility and its trading products, you’ll want to dig deeper. There’s a whole ecosystem worth exploring, often referred to as the “vol world.”

Fortunately, there are plenty of high-quality resources out there, especially on platforms like X (formerly Twitter). The volatility corner of X is home to some incredibly sharp traders and market thinkers—many of whom are generous with their knowledge and insights.

I’ll include some of the best accounts and tools at the end of this post to help you level up your research.

At its core, the VIX index measures the market’s expectation of price fluctuations in the S&P 500 over the next 30 days, based on options pricing. It's often called the market’s “fear gauge.” When VIX is high, markets are nervous. When VIX is low, the market’s feeling calm. It typically moves inversely to equity indices like the S&P 500.

Why should you care? Because:

The VIX can be a forecasting tool.

It offers unique trading opportunities via its related products.

And it behaves unlike almost anything else in the market.

How Do You Trade the VIX?

You can’t trade the VIX index directly. You can only trade futures, options, or ETNs (like $UVXY) that track it.

$UVXY is the most heavily traded VIX ETN. It’s supposed to return 1.5x the daily performance of the VIX index. But with an average annual return of around -80%, it’s safe to say… their aim is off.

This is because $UVXY holds a rolling portfolio of the two nearest-month VIX futures contracts. Since futures expire, $UVXY constantly sells the nearer month and buys the further one.

Why $UVXY Is a Dumpster Fire: One Word—Contango

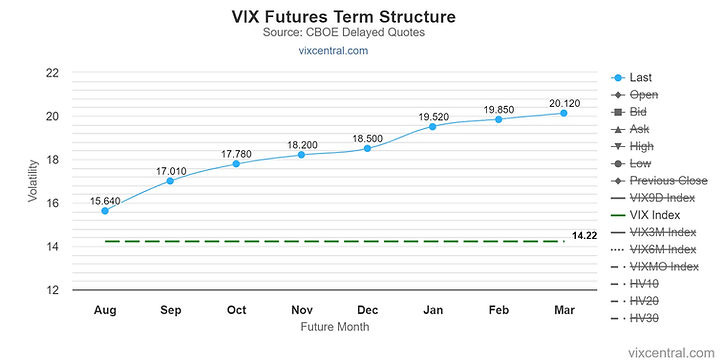

Contango is what we call the situation when the VIX futures contracts are trading at a premium to the VIX index. For example, let us say at the beginning of January the VIX index is at 20, the January VIX future is at 22 and the February future is at 24. This means you are paying somewhere between 22 and 24 for your “exposure” to the VIX index which is sitting a 20.

If the VIX index remains at 20 as January passes, the February and March VIX futures will steadily lose value as they converge to 20 because a VIX futures contract at expiration will be equal to the spot price of the VIX index. Since $UVXY tracks the daily percentage change of a mixture of these two contracts that are steadily losing value in this scenario, $UVXY also loses value. Here is an example of VIX futures in contango:

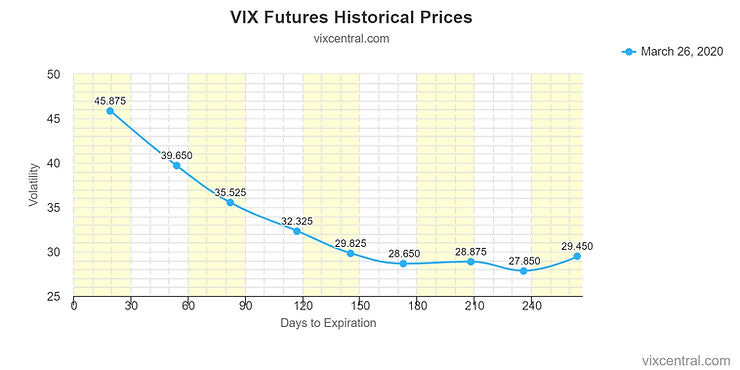

The inverse of contango is backwardation, and this happens when the VIX futures trade at a discount to the VIX index, and typically happens when the VIX index is elevated. During backwardation, assuming the VIX index remains elevated, the VIX futures will gain value over time as they rise to meet the higher VIX index, and as the futures rise, so would the value of $UVXY. As you can tell by looking at the state of the $UVXY chart, backwardation is much rarer than contango. Here is an example of VIX futures in backwardation:

The VIX Term Structure

$UVXY tracks two VIX futures at a time. The relationship between these two—called the term structure—affects how quickly $UVXY decays or accelerates.

The steeper the contango, the faster the decay. And if contango persists (as it often does), $UVXY bleeds value like a sieve. And vice versa for backwardation.

Here’s what that means:

If the market stays relatively calm and contango holds, $UVXY will keep dropping.

Again. And again. And again.

VIX’s Hidden Secret: Mean Reversion

Another important, and unique quirk I should mention about VIX, is that it reverts to its mean over the long term. Look at this chart below, and you will see that after every big spike, it eventually comes back down, but how long it takes to come back down varies.

How to Profit

As I mentioned earlier, I’ll leave the heavy-lifting of building a strategy to you. Crafting a winning strategy is one of the most rewarding aspects of trading. Creativity plays a crucial role in this process, and it's refreshing to apply some thinking outside the box in a field that often penalizes overthinking.

Below, I’ve included resources that can jump-start your process. Many experienced volatility traders openly share their insights—and in some cases, their playbooks. But don’t just copy and paste. Instead, focus on understanding the mechanics behind the strategy and why the edge exists.

Shorting $UVXY: A Simple Strategy, But Not Without Risk

I’ve already shared one VIX strategy: shorting $UVXY. While the returns have been eye-popping, I strongly caution against blindly shorting $UVXY (or any other volatility product) without first doing your homework. Before diving in, I recommend:

Inspecting the VIX futures curve: This helps you understand where the product is headed.

Knowing the mechanics of the trade: Specifically, how to rebalance your position as needed.

Considering the costs: Don’t forget the management fee associated with $UVXY, borrowing costs for shorting, and any interest fees your broker may charge.

And above all—set clear risk parameters. Trading without a risk management plan is a fast track to disaster.

Learn from the Pain

The chart above demonstrates just how painful an ill-timed and poorly managed short volatility trade can be—a 20x loss in just a few weeks back in early 2020.

To avoid such catastrophic losses:

Have rules in place for when to cover your short position. One of the simplest is covering when the VIX curve slips into backwardation (when the near-term VIX futures are priced below the longer-term futures).

Hedge your position: This might mean being short the S&P 500 to provide balance in the event of unexpected volatility. Again, carefully understand the mechanics of hedging before jumping in; even a well-placed hedge will provide little protection if the market goes in full-on panic mode.

Quantitative & Systematic Approaches

Many of the most successful VIX traders take a quantitative or systematic approach. They carefully build mechanical strategies that capitalize on the contango (and, occasionally, backwardation) of the VIX futures curve. In many cases, these strategies revolve around VIX options—an avenue worth exploring if you're ready for more complexity.

Final Word

Volatility products are strange creatures—defined by contango, backwardation, and relentless mean reversion. That quirkiness isn’t noise; it’s opportunity. When an ETN plummets from $100 billion to just $27, it’s not a glitch—it’s a clue that a structural edge exists.

Even if you never trade a single volatility product, understanding vol is non-negotiable. It’s core knowledge for any serious market participant.

But if you do dive into this world, make it count.

Educate yourself. Build a strategy that aligns with your personality and risk tolerance. And above all, make sure it has a real edge.

Good luck out there—and respect the vol.

📚 VIX Tools & Resources

Platforms

VIXCentral.com – VIX futures term structure data

Must-Read Authors

@SinclairEuan – Volatility Trading

@RussellRhoads – Two must-read books on VIX mechanics

Volatility-Focused X Follows

Follow these sharp minds on X:

@bennpeifert

@6_Figure_Invest

@VIXandMore

@vixologist

@Ksidiii

@VolatilityVIX

@KrisAbdelmessih

@Jimmyjude13

@VolatilitySwan

@michaellistman

@OmerRozen_

@selling_theta

@darjohn25

@short_uvxy

@TradeVolatility