I can sniff out a fraud in the world of active trading education from a mile away. The P&L brags, the posted charts with no context and perfectly timed entries and exits—but the easiest tell? Their screens: chart after chart and not one order book

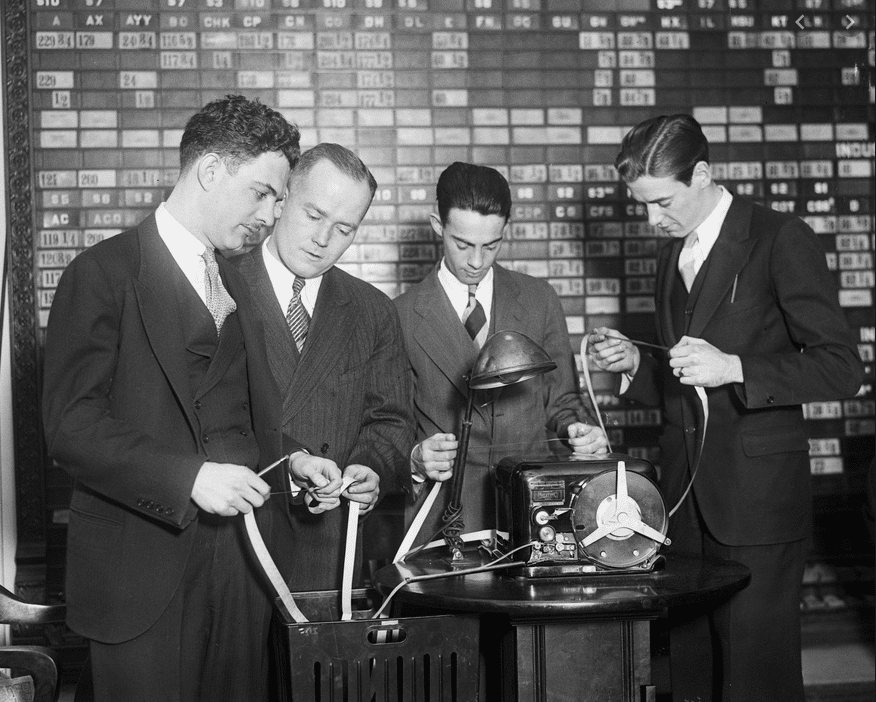

My idols don’t obsess over fancy candlestick patterns. They live and breathe the tape. “The tape tells the truth,” as Jesse Livermore—the legendary figure from Edward Lefèvre’s Reminiscences of a Stock Operator—famously said.

Then there’s my original trading coach, from 25 years ago. Ultra-secretive. He’d kill his monitor every time he stepped away from his desk to take a piss. Not exactly idol material in the conventional sense—but the guy was a cash-printing machine. He rarely had a losing day. And he did it all without ever looking at a chart.

I know—when I bring up that book or talk about my old-school secretive coach, it might sound like I’m stuck in the days of fraction pricing and pager-wearing pit traders screaming at each other. But mastering “the tape”—really learning to read order flow through an order book—is a timeless skill every serious trader needs in their toolkit.

Charts show you where the market’s been. The order book shows you what’s happening right now—who’s buying, at what price, how much they want, and how urgently they want it. Are they lifting the offer? Stepping up their bids? Aggressively chasing fills? paying a big spread? That’s the truth, right there in the tape.

For an active trader, that’s the information that really matters. Not who already bought or sold, or whether those trades formed some cool-looking pattern on a chart. That’s where the edge is for active traders.

In a game where the margins between success and failure are razor-thin, we need every possible advantage. Tape reading—when done right—can provide that edge.

The Tape Today

Has it gotten harder over the years? Absolutely. In most major markets, high-frequency trading and algorithms have made the tape noisier and far more difficult to interpret. Honestly, it was almost too easy when I first started—so easy that the relatively paltry profits traders pulled in back then seem laughable in hindsight.

But the edge isn’t gone—it’s just more selective. And if you know what you’re doing, you can actually use the bots to your advantage—by thinking like one.

Algos play games around big levels, slamming through those levels in one clean sweep, flushing out the hapless retail traders and leaving a nasty wick behind. So you adapt. Instead of getting caught in front of it, you wait for that break, let the wick print—and then you buy.

Certain times of day, specific instruments, and particular market conditions still let the tape speak clearly. And when it does, it can tell you what the charts won’t.

You can also find opportunity in lesser-known or emerging markets—places where algos haven’t completely taken over. Tape reading still works there, offering real-time insights no indicator can replicate. That might mean carefully stepping your offer a penny below a big seller in the “Will Jesus reappear this year?” market on Polymarket—or maybe a penny above a big buyer, assuming they’re trading on inside information. Or front-running the bids of an euphoric herd of social media influencers chasing the latest hot meme coin.

Hell, it could be spotting the year’s hottest Christmas toy, buying a container load, and listing it on eBay—one cent cheaper than everyone else.

That’s tape reading in my book.

Yeah, probably not what you pictured when you first got into trading. But welcome to the real game. Edge is edge. You do what you have to.

Tape Can Make the Difference in Your Edge

You might be thinking: If I’m not scalping, do I even need to read the tape?

Fair question. Tape reading is absolutely critical for scalpers—those who live on razor-thin margins and rely on lightning-fast executions. If you’re a position trader holding for days or weeks with a wide stop loss, trying to save a few extra pennies on execution may seem a waste of effort.

And to some extent, you’re right. But as I touched on in the scalping chapter, tape reading and working your orders can make all the difference. Tape reading is fundamentally about execution—and execution always matters.

Those pennies add up, especially when you’re trading size. Often, it’s not just pennies—it’s dollars. In higher-priced or less liquid stocks, working your order through the book, getting hit on the bid, or patiently waiting for the spread to tighten instead of smashing the offer on a fat spread can save you serious money.

That savings? That’s the difference between a good entry and a bad one. It’s the difference between having an edge and not.

That said, tape reading is only one piece of the puzzle. While it’s incredibly powerful for execution and real-time insight, it shouldn’t be your sole tool. Even my old-school coach, who relied exclusively on order books, could have gained an edge by adding position traders’ favorite tool: charts. Charts help visualize key levels, trends, and market context.

Combining tape reading with other skills and tools maximizes your edge. No single method is a silver bullet; it’s the synergy of multiple tools that creates real advantage.

Learning the Tape

There was a reason I gave applicants an abstract reasoning test at my old prop firm—it measures a person’s ability to recognize patterns and think non-linearly. And that, in my experience, is exactly what tape reading is all about. Pattern recognition lies at the heart of trading itself.

The tape doesn’t hand you answers—it whispers them. And your job is to notice the subtle cues, the rhythms of buying and selling pressure, the shifts in urgency and intent.

If you can develop that pattern recognition skill—really train your mind to spot what others miss—you’ll be well on your way to reading the tape like a pro. And developing that skill mostly comes down to one thing: staring at order books for hours on end. Training your brain. Watching. Rewatching. Noticing the subtle patterns and games market participants play. There’s no magic hack. Sure, having guidance from a skilled tape reader can speed things up—I’ve included some helpful links below—but make no mistake: you still have to put in the time.

Tape Reading is Art, Not Science

And remember: tape reading is more art than science. Two experienced tape readers can watch the same market and trade it completely differently. My own brother and I share the same genetics and have both been staring at order books for over 20 years—but we approach things in totally different ways. He likes a thick book with a tight spread; I prefer a big spread and thinner liquidity. Some traders specialize in spotting hidden orders or icebergs; others zero in on massive visible bids and offers.

There’s no one “right” way—just the way that fits you. But it always starts with putting in the time.

Tape Reading Tips

1. Get the Right Hardware, Software, and Data Feeds

Tape reading—especially when paired with scalping—is more like competitive gaming than traditional finance. You need serious gear:

A fast, stable computer

A solid workstation

Low-latency trading software with customizable hotkeys

Stop worrying about how many technical indicators your platform offers. Worry about whether you can actually see the tape. Spotting a big buyer matters—Fibonacci bands don’t.

Look for platforms that let you:

Filter or highlight large bids, offers, and trades. Find iceberg orders

Aggregate fragmented liquidity across venues

Just as important: subscribe to all relevant exchanges and use real-time, premium data feeds. Without accurate data, you’re flying blind—and that’s a fast way to lose in this game.

2. Time & Sales is Crucial

Always use the order book alongside the time & sales window. The order book shows intent; time & sales shows execution. A big bid might seem bullish—but if all the trades are hitting that bid, that’s bearish. A 100-share trade? Probably noise. A 100,000-share print? That’s intent — pay attention.

Focus on execution, not just what’s shown. Watch what’s actually getting done.

3. Know the Rules

Every market and exchange has its own unique rules and fee structures—so it’s crucial to understand them inside and out. When tape reading equities, for example, you need to be aware of:

ECN (Electronic Communication Network) schedules: Know when different ECNs—or order routes/exchanges—open and close. Market hours vary across these venues, and timing your orders around their active sessions can impact execution quality and liquidity.

Routing destinations: Understand where these ECNs route orders—do they send them to dark pools or other venues? Also, be aware that routing destinations can change depending on the time of day.

Fee structures: This is huge. Know the fees for the different ECNs you trade on—and here’s a key insight: on most of them, you can actually get paid for adding liquidity through limit orders (provided your broker passes these rebates on). If your bid gets hit or your offer lifted, you may receive a small rebate. Conversely, removing liquidity—by hitting bids or lifting offers—often incurs a fee. These small credits and charges add up fast, especially in high-frequency or high-volume trading. Knowing how to act accordingly can save or earn you real money.

Short selling rules: Can you short the stock without borrowing shares? If not, what are the borrowing costs?

Uptick rules: Is the stock subject to uptick restrictions, meaning it can only be shorted on an uptick?

Order size display: How is order size shown? Can you hide your order size? Does hiding your true size push you to the back of the queue?

Understanding these details helps you navigate the market smarter and avoid costly surprises. Execution isn’t just about timing—it’s about knowing how the market’s plumbing works and leveraging it to your advantage.

4. Don’t Go Down Like the Titanic

Watch out for iceberg orders—hidden size that doesn’t show up in the order book. What looks like 100 shares or 1 contract might actually be thousands, quietly refreshing as they get filled. These stealthy orders can trap unsuspecting traders who think they’re about to break through a level. Skilled tape readers spot the signs: repeated prints at the same price, size that mysteriously refills, or a wall that never moves. Whether you avoid them, trade around them, recognizing icebergs is crucial to survival. Heck, some traders build entire strategies around exploiting them.

5. Spot the Patterns

Tape reading is pattern recognition. Maybe a large bid appears every day at 10:15 AM. Maybe a seller always posts the same size at the same level. These behaviors aren't random. They’re footprints. Learn to spot them, and find a way to take advantage of them.

6. Panicky or Aggressive Buyers and Sellers

A static bid is just interest—but a bid that keeps moving up? That’s intent. When a buyer keeps raising their price or a seller keeps undercutting themselves, it signals urgency. Maybe they're chasing fills for a large position, or they're being forced to liquidate. That kind of aggression often reveals institutional activity or emotional trading. These are the orders that matter—they move markets.

7. The Spread Can Be Your Edge

Most traders avoid instruments with wide spreads because hitting bids and offers can quickly eat away at profits. But a big spread can actually be an advantage if you know how to play it. Getting filled on the bid or offer of a stock with a wide spread can be advantageous, and market making—placing buy and sell orders on both sides of the spread—is a timeless and powerful strategy. By carefully bracketing your orders within a wide spread, you can capture the difference and control your risk (Spoiler alert: there’s plenty of competition in this lucrative game.)

Don’t fear the spread—use it.

8. Timing

As an equity trader, I’ve found that tape reading during regular market hours has become nearly impossible—bots dominate and can overwhelm human traders. However, in the pre-market and after-hours sessions, the tape still speaks clearly. Those quieter times give tape readers a chance to shine and find real opportunities without getting drowned out by algorithmic noise. Similar quirks exist in other markets too.

9. Choose the Right Instrument

Don’t try to tape read $SPY, S&P futures or Bitcoin—those markets are too deep, too fast, and too automated. Instead, look at small caps, lower-volume contracts or coins. In thinner and less automated markets, the tape still whispers secrets.

10. Explore the Right Markets

With bots infesting most major venues, look to fragmented or emerging markets—Polymarket, niche crypto exchanges, alternative stock markets, thinly traded altcoins. Anywhere algos haven’t drowned the signal.

Bottom Line

Tape reading is one of the few real-time edges left for active traders. It’s not about looking at where the market’s been—it’s about seeing where it’s going right now. While charts show history, the tape reveals urgency, aggression, hesitation, and intent. And that’s where edge lives. In a world flooded with lagging indicators and algorithmic noise, reading the tape lets you anticipate moves, not just react to them.

It’s not easy. The tape won’t hand you answers—it whispers clues. And learning its language takes time, repetition, and a sharp eye for pattern recognition. But if you put in the work, it becomes a powerful tool—one that cuts through the noise and gives you a glimpse behind the curtain. Whether you’re scalping, swinging, or just trying to get better fills, tape reading is still one of the sharpest weapons in a trader’s arsenal.

While books, social media, and countless online platforms are overflowing with technical analysis content, tape reading remains a much less documented art. I plan to help fill that gap by putting together something useful and real—but don’t hold your breath waiting for it. In the meantime, here are a few resources. I haven’t necessarily watched these videos or endorsed the content, but I do trust these traders: